Home » Posts tagged 'Inequality'

Tag Archives: Inequality

Has Trump got the right economic plan?

by John Brian Shannon | December 5, 2016

Donald Trump won the 2016 election in an upset defeating the expected winner Hillary Clinton, because to voters, he represented change while Hillary represented the status quo.

His potential second term in office four years on, depends upon one thing; Will he have addressed the concerns of those who voted for him?

Disaffected and disillusioned voters put Mr. Trump into office. And just who are those people?

They’re the bottom-two economic quintiles, with some votes coming from the other quintiles, to be sure. But protest votes aren’t cast by those happy with their lot in life — which is to say; The Wealthy.

The protest voters are those among the 100 million that have given up looking for work — not the wholly unrealistic 4.9% official unemployment rate statistic, which shouldn’t ever be considered a metric on it’s own. It’s a junk stat. Not true at all. Meaningless.

Any official unemployment stat should tell the whole truth — both regular unemployed’s, long term unemployed’s that have simply ‘given up’ looking for work, and it should include those on welfare willing to work (if they could find a job that would pay them enough to cover their basic needs) because most of those people were workers until their jobs were off-shored and their income tax contributions ended.

If Donald Trump solves inequality or even beats it back to a reasonable degree, he will likely win a second term in office; It will mean he listened to his constituents

Solving it via government handouts seems to be ‘out’ in a Trump administration but solving inequality via a $1 trillion infrastructure plan seems eminently reasonable, logical, and inspires hope for individuals and will work to add confidence to markets.

If 100 million people were to ‘suddenly’ get jobs (that’s the 100 million unemployed over and above the false official stat of 4.9%) in the United States over the next four years, watch the economy leap forward, the debt-to-GDP stat fall, total tax revenue will surge dramatically, and deficit spending could (and should) become a thing of the past.

Revenue-neutral? I’d like to hear more about that!

Privatizing America’s national parks? Confiscating the wealth of the 1 percent? Selling NASA to a group headed by Elon Musk? Selling the SouthWest to Mexico?

There are all kinds of ways to raise $1 trillion dollars to fund a national infrastructure program, but do we really want to do those things? Not really.

Well… selling NASA to Elon Musk (were he able to raise such a huge amount of capital) could inject some interesting entrepreneurial vigor into that legendary administration.

Incentivizing corporations via tax relief always results in more profits but rarely results in more infrastructure spending. Proved history on that

So where will that trillion come from?

IF ‘The Donald’ is thinking American citizens and U.S. corporations will invest in America’s infrastructure by buying ‘road building bonds’ and thereby lower their overall tax bill, it’s a brilliant plan

For individuals or corporations buying such bonds, whatever money they put toward it should be considered ‘taxation-free’ money by the IRS. (No tax payable on any money used to buy national road building bonds, and no tax payable on those bond dividends)

American citizens, U.S. corporations, and U.S. investor groups should get first dibs on it. From a psychological perspective, having American citizens and U.S. corporations ‘buying-in’ to such a goal is almost as good as getting the investment itself.

After two years it could be opened up to non-Americans and global institutional investors.

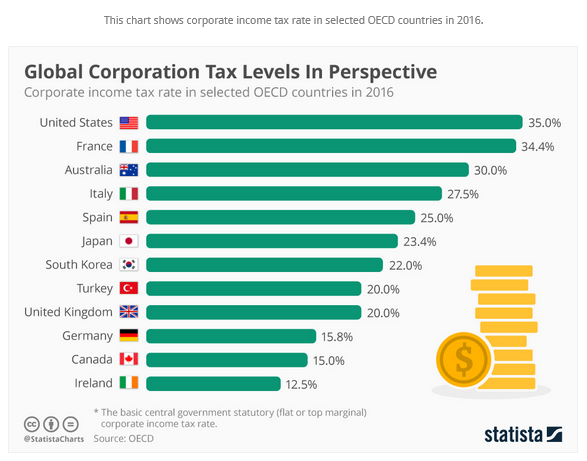

Also, the U.S. corporate tax rate should be harmonized to Canada’s lower corporate tax rate.

That should’ve been a part of the original NAFTA agreement, and it’s still not too late to add it in.

United States Economy: Has President-elect Donald Trump got the right economic plan? Image courtesy of Statista.com

It’s ridiculous that the NAFTA partners have three different corporate taxation levels

Remember when senior executives at Burger King wanted to move their corporate HQ to Canada to save billions in taxes?

I’m sure it’s not the only example that wreaked havoc in the political relations between NAFTA partners and caused some to wonder if America’s commitment to ‘Free Trade’ was serious, as the proposed Burger King move was overruled by the Obama administration.

You either believe in Free Trade or you don’t, you can’t have it both ways. Capitalism OR Statism — your choice.

With a corporate tax rate standardized to the lowest of the three NAFTA partner countries (Canada’s is the lowest) such moves and threats of moves, would become a thing of the past, while the lower tax rate would find some of those extra profits moving to U.S. infrastructure spending, “To Make America Great” again.

Finally, the UK should be invited to join NAFTA and match their corporate tax rate with Canada/U.S.A./Mexico

Such trade harmonization will lead to better political relations and less economic infighting between existing and potential NAFTA partners, concomitant with a trillion dollars earmarked for federal infrastructure spending courtesy of a tax-free road building bond scheme.

That’s the way to ‘Make America Great’

Related Article:

- Will Trump’s Plan Really Boost US Demand? (Project Syndicate)

Wealth and Inequality in America

by John Brian Shannon | August 23, 2016

With the greatest respect, I challenge anyone who uses the term ‘earned success’ as if to mean that anyone who isn’t financially successful in the United States is poor because they haven’t earned any success.

We know from countless studies that people born into wealthy families remain wealthy in the vast majority of cases. And we know that people born into poverty remain poor in the vast majority of cases.

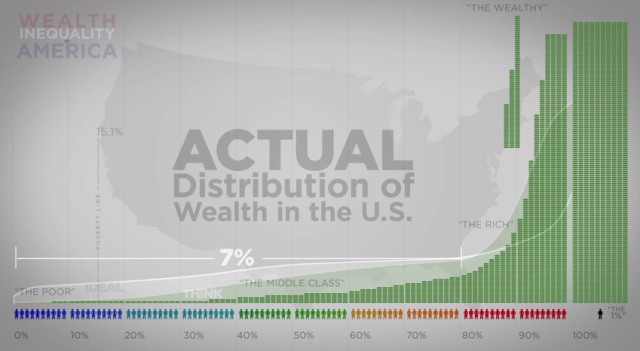

The chart reveals the bottom 80% of Americans own just 7% of the nation’s wealth.

Contrary to perceptions, the odds of moving from wealth to poverty, or from poverty to wealth in a person’s lifetime are incredibly slim. In 98.5% of all cases, if you’re born wealthy you’ll remain wealthy. You didn’t ‘earn’ it — you simply had the dumb luck of being born into the top economic quintile.

Our civilization should stop penalizing people for the apparent crime of being born into the wrong family or the wrong generation. Ask the Millennials about ‘lowered expectations’…

And yet, so easy to fix.

By providing free university education to all young people we could wipe out multi-generational poverty and lower crime stats concomitantly.

We see this in bold relief in countries like Norway, Sweden, Germany, Austria, and Chile where, since introducing free university education, all markers from productivity, to social tranquility, to lower crime stats, to unemployment, and even intangibles like a wider and more wholesome worldview suddenly appeared in their national statistics.

When every American has one university degree by age 22 watch the bad stats fall and the good stats increase!

Including unemployment. After all, who is going to mope around the United States unemployed with a valuable university degree tucked under their arm? Not one.

They’ll be taking off to Canada, Europe, Africa, and the other continents to work there and to act as ‘brand ambassadors’ for the United States and to broaden out America’s contact list of potential partners.

I could write a book on how it is now, vs. how it could be.

Anyways, it’s all good. The question is; How to afford it?

There are many ways to fund a guaranteed university education for every student; An across-the-board 1% income tax increase, a new tax such as a federal Goods and Services Tax that splits revenue 50/50 with states, or a 5% import tariff, or a per student tax break for universities, or (my favorite) students serve their gap year in U.S. military service in order to obtain one free college degree.

“Institute a student military draft.

It’s not like we’re going to war, or that we’re likely to start a new war, anytime soon.

Each young person should be required to serve one year of compulsory military service (their gap year) and be free to choose when they want to serve their military service — as long as it’s successfully completed by age 25.

Maybe the U.S. Army Corps of Engineers could partner-up with Habitat for Humanity to get the student cadets some hands-on experience and see realworld problems and solutions, firsthand.

With significant numbers of students fulfilling their ‘gap year’ responsibilities to the military, it leaves that many fewer students to compete for the same jobs or internships.

Which will obviously drive up demand among their typical employers, and thereby drive up their wages — thereby making demand for their employment comparable to the demand experienced by their parent’s generation.

Not only would these kids learn valuable skills, they would form lifelong friendships and have the opportunity to meet other kids from all parts of the country and from all walks of life.

And a real shot at a quality job with decent pay once they complete their schooling.” — Solving Youth Unemployment and High Student Debt in America

Of course, this would require reversing only a small portion of recent military cuts.

And even if it meant an incremental federal deficit increase, so many other costs would fall that it would soon become a Win-Win proposition for the United States.

Costs to taxpayers, like poverty alleviation schemes (welfare and SNAP) homelessness, crime, policing, court and incarceration costs, and many other wholly unnecessary costs could be reduced or eliminated merely by adding one college degree to each person’s life experience/résumé.

“Some 46 million people, about one-seventh of the US population, receive monthly and other benefits [like the Supplemental Nutrition Assistance Program] totaling $75 billion per year. Despite its widespread use, the government estimates that only about 70% of those who are eligible receive benefits.” — Martin Feldstein

That’s failure by any standard.

“The best way to help the poor is the negative income tax plan originally proposed by both Milton Friedman (the conservative economist at the University of Chicago) and James Tobin (the liberal economist at Yale University). All households below the age of 65 would receive an amount of money that would keep them out of poverty if they had no other income; but the amount of the transfer would decline gradually as their household income rose. Above a certain threshold, the household would pay an income tax as they do today; below that level, the “tax” would be negative.” — Martin Feldstein

The negative tax idea is a great idea.

If my idea, the compulsory gap-year military service/one free college degree/5% Pentagon budget increase doesn’t fly, I’d enthusiastically endorse negative tax legislation.

Inequality is the one problem in America from which many other problems flow. It’s time for politicians to stop talking and solve the problem.

Related Article:

- Reducing Inequality and Poverty in America (Project Syndicate)

- 80% of Americans own an unbelievably small portion of the country’s wealth (Business Insider)

- America’s explosion of income inequality, in one amazing animated chart (Los Angeles Times)

- Data and Chart Pack (Inequality.org)

The Silver Bullet for the U.S. Economy

by John Brian Shannon | January 28, 2016

How balancing the economy can give us the best work/life balance. Or is it the other way around?

For those of us fortunate to be born in a Western nation, life is mostly about balance, and for our elected leaders it’s about how to achieve balance in the wider economy, and about the kinds of policies we’ll need for the future.

Thus far, our political and economic model has evolved. But let’s never forget that it wasn’t designed, it evolved. Big difference. (It might be the best Model T Ford ever built, but it’s still a Model T, if you catch my meaning)

And that’s exactly the conversation that we need to have

Here in North America, it requires only 1% of the workers (and presumably 1% of the total available investment pool) to produce enough food to feed everyone on the continent. Yet, we see major food distribution problems and it’s getting worse.

With regards to agricultural output and distribution, our North American model is the best devised but it’s far from perfect. And that is my point, instead of waging trillion dollar wars we should have continued to improve our economic model, especially in regards to the food distribution aspect.

I don’t think that we should be giving food away for free (except in emergency situations) but there are far too many Food Banks in operation for such an affluent society, and there is constant demand for more of them.

Q: And why do we have this particular symptom that I’ve singled-out for discussion?

A: There are far too many idle hands, and it’s because their jobs picked up and went to Asia — a process that began in 1973.

We could put an end to many social ills by employing every worker for a minimum of 6 months per year

By legislating mandatory job-sharing, every worker in the U.S. would be guaranteed a job appropriate to their particular skillset for a minimum of 25 weeks of full time employment, annually.

That means every worker has a full time job for a minimum of 6 months of every year and is then eligible to receive automatic unemployment insurance benefits during their (short) layoff period.

Mandatory job-sharing eliminates the need for ‘Welfare’

We know that long-term unemployed individuals eventually turn to welfare in order to be able to eat, have shelter, etc. once their unemployment insurance payments run out.

We also know that long-term unemployment eventually turns into substance abuse, crime, homelessness, and other social ills.

More crime = bigger policing budgets = bigger insurance claims/higher insurance rates = more citizens injured or terrorized by crime, etc… all of that are the symptoms of high and long-term unemployment, progression to welfare, and changes in the thinking of the individuals in such circumstances, including long term depression, withdrawing from society, anger, resentment, and more.

But with mandatory job-sharing the yearly unemployment rate would be 0% — that is, over the course of the year, every worker will have worked a minimum of 6 months. However, at any given point throughout the year the nominal unemployment rate would settle at 2.5%-3.0%.

With a job (and full unemployment benefits during layoff) long-term unemployment would become a thing of the past.

Keeping workers in a state of long-term unemployment brings on an OCEAN of troubles

Job-sharing is the answer.

By legislating that every healthy worker in the U.S. has a job for a minimum of 25 weeks annually, we could solve the worst inequality, poverty, other social ills, and dramatically and positively lower crime rates, insurance rates, policing and court costs, and enjoy a safer, more egalitarian society.

It’s so simple.

Related Articles:

- Economics in the Age of Abundance (Project Syndicate)

- In Sweden, Nobody Sleeps in Dumpsters (John Brian Shannon)

- The Secret of Norway’s Success (John Brian Shannon)

- If Norway Can Succeed Like This, Why Can’t Every Country? (John Brian Shannon)

- Can Switzerland’s amazing success story be exported? (John Brian Shannon)

“I have only one yardstick by which I test every major problem — and that yardstick is: ‘Is it good for America?’” — Ike Eisenhower